Why the Rupee is Falling – And Why It Might Not Be a Bad Thing

The Indian Rupee's Fall: Crisis or Opportunity?

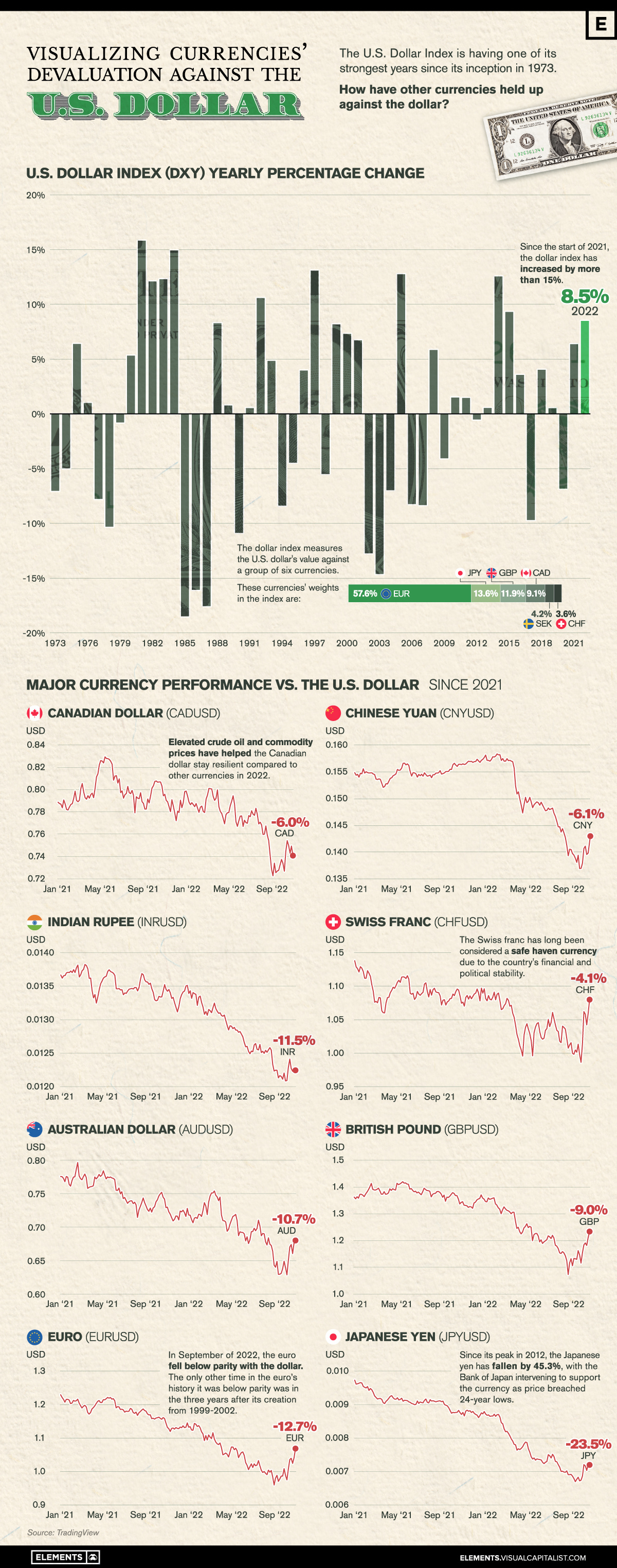

For the past year, headlines have screamed about the Indian Rupee crashing, crossing the ₹87 mark against the U.S. dollar. Politicians, celebrities, and economists have debated this issue intensely. But is the rupee truly weakening, or is the dollar simply getting stronger? More importantly, what does this mean for you?

Let’s break it down.

The Truth About Exchange Rates

The value of a currency is relative—measured against others, especially the U.S. dollar, which dominates global trade. India buys oil in dollars, making the exchange rate crucial to the economy.

Between 2021 and 2022, the rupee moved from ₹72 to ₹82—losing 10% of its value. But Finance Minister Nirmala Sitharaman argued:

“It’s not the rupee sliding, it’s the dollar strengthening.”

And she’s not wrong. Global trends show that the Chinese Yuan fell by 4.1% compared to the dollar, while the rupee only dropped by 1.6% in the same period.

Why is the Dollar Strengthening?

1️⃣ The U.S. Economy is Booming – Higher growth and foreign investments make the dollar more attractive.

2️⃣ Federal Reserve’s Interest Rate Hikes – To control inflation, the U.S. raised interest rates, drawing global investors to American markets.

3️⃣ Foreign Investors Leaving India – As U.S. investments became more rewarding, Indian stock markets saw their lowest foreign investment levels in 12 years.

This increased demand for dollars, making the rupee look weaker by comparison.

The Hidden Impact on India

Not all industries suffer from a weak rupee. In fact, some benefit:

✅ IT & Software Companies – Earning in dollars means higher revenue for Infosys, TCS, and Wipro.

✅ Pharmaceuticals & Exports – India’s medicine exports become cheaper for foreign buyers, boosting profits.

✅ NRI Remittances – Indians working abroad send home more valuable dollars.

However, import-heavy sectors like oil and electronics struggle as prices rise.

Did RBI Waste Billions to Protect the Rupee?

To prevent extreme fluctuations, the Reserve Bank of India (RBI) spent $100–150 billion in forex reserves trying to stabilize the rupee. Critics argue that this was unnecessary, as other currencies also weakened.

In fact, India follows a free-floating exchange rate since 1991, meaning the market should ideally determine its value. But the RBI’s intervention raised questions:

Was it to control inflation?

Was it political pressure?

Was it to protect Indian companies with foreign loans?

Some economists argue that the rupee is actually overvalued by 8% and should be weaker. Yet, India continues to defend its currency, raising further debate.

What Can We Learn?

1️⃣ Don’t Panic Over Currency Depreciation – A weaker rupee isn’t always bad; it depends on the economic context.

2️⃣ Global Events Impact Our Currency – U.S. policies affect Indian markets more than domestic factors.

3️⃣ Smart Investments Matter – If you work in IT, pharma, or exports, a weak rupee could work in your favor.

The Indian rupee’s journey is far from over. What do you think? Should RBI let the market decide, or should it keep defending the rupee?

📩 Reply with your thoughts, and stay tuned for more financial insights in our next edition!